Investment in the Private Rented Sector Apartments (PRS) and student dormitories constituted some 4% of the total real estate investment volume in Poland in the first half of 2022. As in the rest of Europe, this market is gaining in importance. In Poland, the influx of Ukrainian refugees gave it an additional impetus. In the coming months we expect investors to allocate larger volumes of capital to the housing sector including both the rental apartments as well as dormitories.

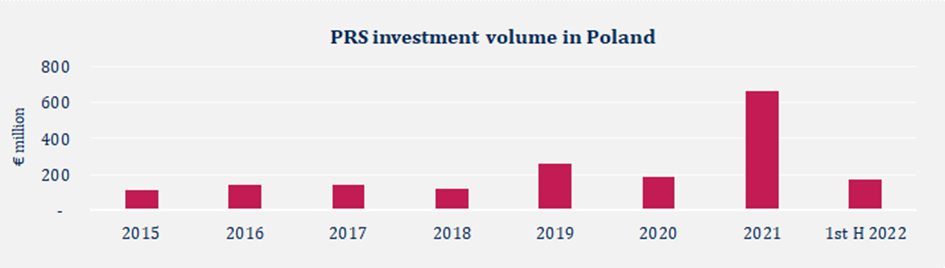

The institutional residential letting market in Poland is only a few years old but it is now developing very quickly. In just a decade, the volume of residential investment transactions (including forward purchase / fund transactions) grew from zero to over € 660 million last year.

The sector will further grow as the level of home ownership is unlikely to increase with worsening affordability. In Poland, over half of apartment purchases are financed with mortgages. Inflation and the rising cost of loans together with the tightening of the banks’ lending policies has led to the first decrease in the number of mortgage loans in at least two decades (to 2.48 million at the end of 2nd Q 2022 from 2.55 million at the end of 2019). In the first eight months of 2022, the number of newly granted loans dropped by 41% and their total value by 36% compared to the same period of the previous year. At the same time consumer confidence has dropped to record low levels. Not surprisingly the number of apartments sold has decreased by fifty percent in the first six months of 2022.

At the same time the rental market is growing with average rental prices up by 25% during the last year. Demand is usually coming from students and 1-2 person households. Additionally, after the outbreak of the war in Ukraine, a high proportion of demand is coming from the community of 2 million of Ukrainian refugees staying in Poland. Currently, there is an obvious lack of supply on the residential letting market and the demand exceeds the supply.

The PRS sector is therefore very attractive to investors and in the following months we expect to see a growth in number of transactions. Until today, most of the transactions were in form of forward purchase/forward funding due to a lack of existing product on the market. The entire PRS stock in Poland is 8 500; but 54 000 is in pipeline. In the coming months however the number of asset transactions could rise as residential developers suffer from a lack of demand from individuals buyers.

An attractive asset class is also that of student dormitories/flats. These are more resistant to economic fluctuations compared to other commercial properties. The advantage of the Polish market is its high number of students (1.2 million) and low supply of residential accommodation as only 10% of students have places in dormitories. Thus demand is very high, as evidenced by an unprecedented occupancy level of almost 100%.

In the current macroeconomic environment, two trends will clash on the housing market in the near future. On the one hand, rising construction costs and a falling sales prices discourage developers from starting new construction projects, but on the other, rising rental prices and demand from institutional buyers favour the sector’s development .