Real estate investment volume in Poland remained high in 2022 despite the continuing war in neighbouring Ukraine and record high interest rates. At the same time, investment yields have been increasing, especially in the case of secondary properties.

The total value of real estate investment transactions in Poland last year amounted to over € 5.8 billion some 2% more than in 2021 and 9% more than in 2020. However, there is still a significant gap between the current market and the 2019 peak when the total the value of investment transactions amounted to over € 7.8 billion.

There were over 120 significant transactions concluded in 2022, the second-best result after 2021, when we recorded almost 170 transactions. Also indicative of this positive picture have been the large transactions in respect of prime office buildings including the sale by Ghelamco of the two 130-meter towers of The Warsaw Hub complex for € 583 million at the yield estimated at 4.5%. The complex, built in 2020, was bought in the first quarter of 2022 by Google Poland, which is also the occupier of 20 000 m2 out of a total of 101 000 m2. The latter was the largest ever single office transaction in Poland as well as in Central and Eastern Europe as a whole.

We also noted the first transactions of a large shopping centres since the outbreak of the pandemic including the purchase by NEPI Rockcastle of the 63 500 m2 Forum Gdańsk from Blackstone for € 250 million and the 48 000 m2 Atrium Copernicus in Toruń from G City Europe for € 127 million at yields which we estimate at 6.6% and 7.6% respectively.

However as mentioned above, yields, not surprisingly, for most properties have been rising by 25 to 75 basis points since the start of the war in Ukraine and record high key interest rates. That said, the rise in property yields has been lower than during global financial crisis in 2007-2009 when yields in Poland rose by almost 200 basis points.

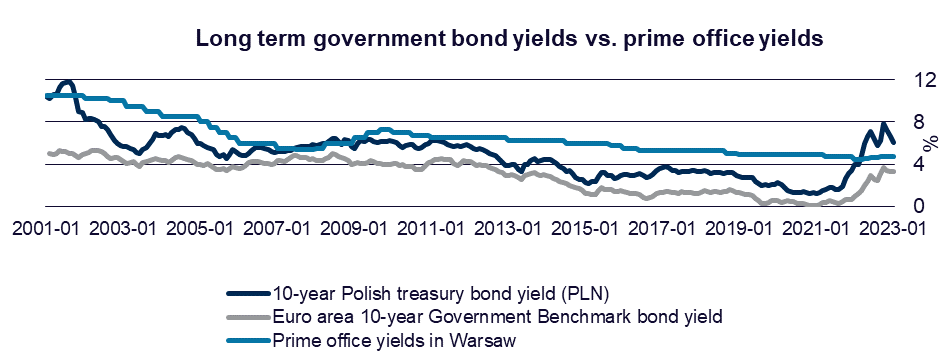

Whist there is some correlation between relatively risk-free 10-year government bonds and property yields, this has been an unstable relationship and the rise in the government bond yields has not led to a comparable rise in property yields.

The variable spread between real estate and government bond yields indicates less volatility in the property investment market which is also influenced by other factors.

Notwithstanding today’s higher returns on property investment, a higher level of market uncertainty has led to a fall in market liquidity as each transaction is more carefully assessed and secondary properties become more difficult to sell. The latter applies primarily to assets of lower quality, especially in poorer locations, with shorter lease periods, higher vacancies and requiring larger capital expenditures on modernisation.

On the other hand well-located, quality properties, with stable cash flows, resistant to aging and environmentally sustainable do provide protection against declining yields even in the face of rising interest rates.