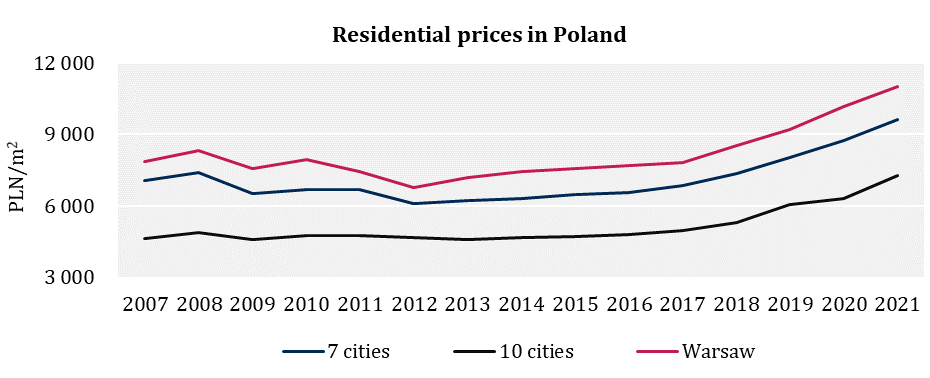

Contrary to original expectations, prices of residential properties in Warsaw have risen by 14% since the outbreak of the pandemic and continue to do so despite unfavourable consumer sentiment and the uncertain macroeconomic environment.

In the third quarter of 2021, the average price of newly developed apartments (on the so-called primary market) in Warsaw hit a record PLN 10 992 per m2.

Prices of residential properties have been rising since Q4 2018 and the pandemic has not halted the trend. The only fall was observed in Q2 2020 when the uncertainty caused by the pandemic and economic downturn resulted in a 4% drop in prices. This however was soon compensated by an 8% rise in the following quarter. Since then, prices have been rising to record highs and not only in Warsaw.

In the seven large cities (Warsaw, Kraków, Łódź, Wrocław, Poznań, Gdańsk and Gdynia) the average price at the end of Q3 2021 stood at PLN 9 638 /m2 some 9% higher than in Q3 2020. Furthermore, in the ten major cities, the average price at the end of Q3 2021 amounted to PLN 7 260 /m2 (13% higher than a year earlier).

Source: National Bank of Poland, 2021 as at 3rd quarter each year.

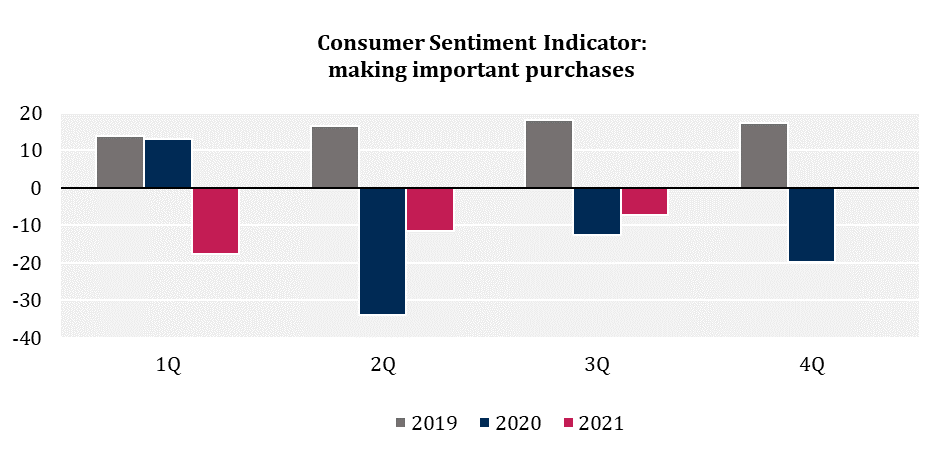

At the same time however, the consumer confidence indicator published by the Central Statistical Office has been negative since the beginning of the pandemic. Thus, the number of consumers with a negative attitude is in the majority. The consumer index of important purchases in 2nd Q 2020 was the lowest since 2003 at -34 (on a scale from 100 to -100). In subsequent quarters the index improved albeit still to a negative -7.3 in Q3 2021. Cleary the consumer confidence index is influenced by the pandemic situation and falls with increasing Covid cases and lockdowns.

Source: Central Statistical Office, 2021.

Notwithstanding the negative consumer confidence index, residential prices continue to rise due to several other factors as follows:

- Increased demand. Working and learning from home has created the need for more space for many families. In addition, wealthier households hastened their decision to purchase second homes.

- Growing inflation. Inflation in Poland has been rising since the beginning of the year and in October stood at 6.8% – the highest in 20 years. Buying an apartment/ house is seen as a good hedge against inflation especially when mortgage rates are so low.

- Low interest rates. During the pandemic, interest rates were gradually pushed down to the lowest ever level of 0.1% (from 1.5% before the pandemic). As a result, mortgage rates decreased encouraging a higher take up of loans. In fact, during the pandemic, the number of loan applications increased from quarter to quarter and, according to the Polish Banking Association, in Q2 2021 they amounted to 67 000 (17% more than in Q1 and 48% more than in Q2 2020). The National Bank of Poland base rate has increased in response to inflation to 1.25% since the beginning of November albeit it is still below the pre-pandemic level of 1.5%.

- Stable new supply. New supply is not keeping up with demand as the number of apartments completed in the 7 largest cities in 2020 amounted to 63 949 compared to 64 027 in 2019. The situation did not improve in the first half of 2021 as the number of apartments completed in the largest cities decreased by 5% compared to the first half of 2020. In addition, some of the new supply was pre-purchased by institutional buyers for letting. The growing private rented sector in Poland will further limit the new supply put on sale in the near future or for at least the next two years.

Of course, the rise in residential property prices seems to be a global trend. Prices are rising not only in Poland, but in most developed countries because of increased demand resulting from the work from home trend and the combination of monetary and fiscal policies giving rise to lower interest rates. The spectre of high inflation however may see a reversal of the trend going into the New Year.