E-commerce

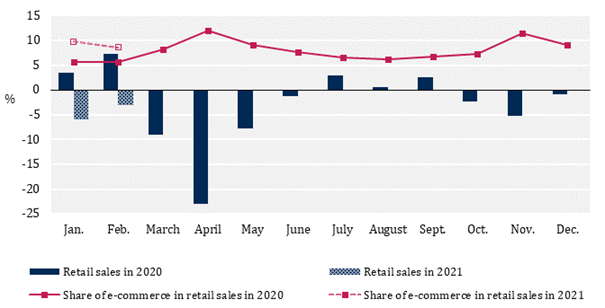

China will be the first country in which the majority of retail sales will come from e-commerce. The forecast from global market research company eMarketer is that e-commerce in China will reach 52% of total retail sales this year, an impressive increase from 44.8% in 2020 and 1% in 2008. In second place is South Korea at 28.9%. In Europe, the United Kingdom will lead the way this year at 28.3% compared to the expected average for Western Europe of 12.8%. In Poland, internet sales are likely to exceed 10% this year up from 5.6% in the pre-pandemic months. Already internet sales in Poland during the hard lockdowns in April and November last year have exceeded 11%.

At the same time total retail sales in Poland are falling, having shrunk by 3.1% in 2020. Last year, all retail categories recorded decreases except for sales of furniture and electronics which perhaps unsurprisingly increased by 4.7% year on year. The largest drop of 15.9% was recorded by fashion and footwear sectors and food, beverages and cigarettes dropped by 1.9%.

Retail sales and share of e-commerce in in Poland

Polish Properties (based on figures from the Central Statistical Office) .

Further increases in e-commerce are expected not only because of the pandemic which forced consumers to shop online but because of Poland’s high percentage of household access to the internet. In 2020 it stood at 90.4%, an increase from 84.2% in 2018 (Central Statistical Office – GUS). Also 2020 saw a large increase in the number of internet card transactions. In the 3rd quarter, 38 million of such transactions were recorded, 4.4 million more than in the previous quarter.

Real estate market

The rise of e-commerce at the expense of shopping centres has led to an increasing demand for warehousing space and we are observing an unprecedented increase in the volume of investment transactions in respect of warehouse properties with yields now on a par with those in respect of prime offices in Warsaw.

Thus in 2020, transactions in respect of warehouse properties amounted to 50% of all real estate investment sales, up from 21% recorded in 2019. On the other hand, the percentage share of retail property transactions in relation to the total investment volume decreased from 54% in 2015 to 12% in 2020. The value of warehouse investment transactions in 2020 was over € 2.6 billion, 39% more than 2019 and more than ever recorded in the retail sector.

Volume of warehouse and retail property investment in Poland (million €)

Polish Properties.

Moreover, since the outbreak of the pandemic, most of the retail property sales were in respect of small retail parks and convenience shopping centres in tertiary towns, or those properties least vulnerable to competition from online sales. There has been a noticeable lack of sales of large shopping centres in the major cities with falling rental income and yields perceived at 25 to 50 basis points above pre-pandemic levels.

On the other hand, yields in respect of prime big box warehouse and logistic properties are now at below 6% and falling. Furthermore, “built to suit” warehouse properties with long-term lease agreements are being transacted at yields of below 5% as in the case of the recent transaction of a 101 000 m2 Castorama warehouse in central Poland which was sold at a reported € 65.5 million representing an initial yield of 4.95%.