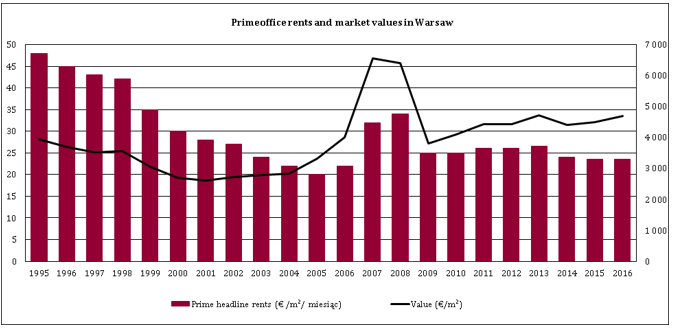

Rents for office space in Warsaw have been constantly falling. In 1995 prime office buildings in Warsaw were leased at € 48/m2 per month. Today rents stand at about half that figure. The most spectacular falls were observed in the first 11 years of the fledgling market as a result of both the growing supply and a maturing market. Rental increases were observed only during 2006 – 2008 and 2011 – 2013. Currently, given a large oversupply, the trend is again downwards. Thus, in the last 21 years we have witnessed 15 years of falling rents and only 6 years of rising rents.

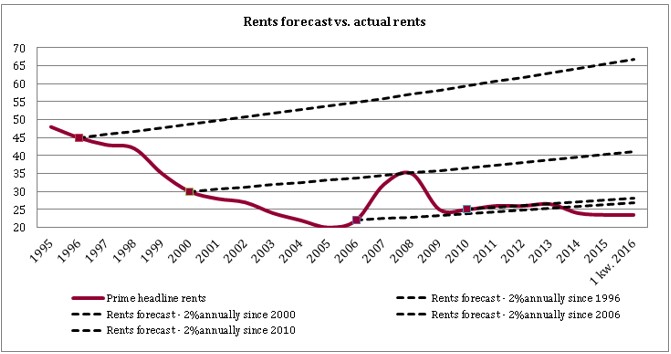

Meanwhile, the market practice amongst valuers in Poland has been to forecast cash flows assuming rental indexation typically at around 2% annually. But has this been defensible?

If a 2% annual rental increase had been assumed in 1996, today the rental level would be € 67 per m² per month. The same assumption made in 2000 would lead us to € 41 per m²per month today. Short-term forecasts are closer to the mark. Thus assuming a 2% annual growth rate in 2010 would give us a rent today of € 28 per m² per month compared to the actual market level of € 23.5 per m² per month.

However, the declines in rental rates do not rule out the profitability of office investments because at the same time yields have fallen and the value of buildings per m² has increased.

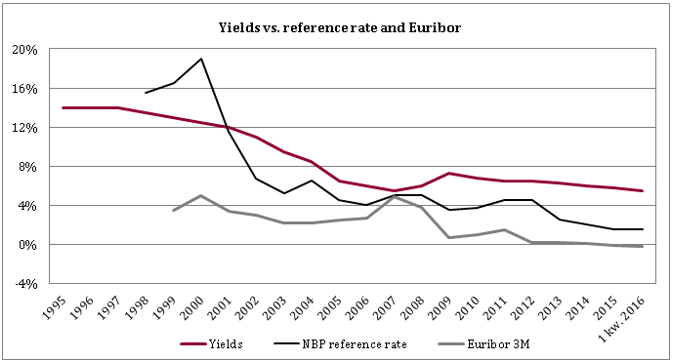

The return on an office investment is also affected by factors such as costs and availability of financing and the effects of leverage which in recent years worked in favour of investors.

The cost of financing has fallen significantly since the 1990s leading to the growth of returns on real estate investments. In February 1998 the bank reference rate, as determined by the National Bank of Poland for the first time stood at 24%. Today it is down to 1.5%.

Prime office yields are also falling. The first transaction in Poland in respect of a commercial building in 1997 was agreed at a yield of 13.25%. This was the sale of the Wiśniowy Business Park A office building for € 13.5 million. Today prime yields in Warsaw are at the historically low level of 5.5%, much higher than the rate on 10-year government bonds, which currently stands at 2.5%.

Thus, the value per m² of prime office buildings has been rising. In the mid-1990’s, the best office buildings were valued at approx. € 3 900 per m². Today the corresponding value is up to between € 4 500 and € 5 000 per m². As a result, even with falling rents, commercial real estate still ensures good capital returns.